7 4: Effects of Choosing Different Inventory Methods Business LibreTexts

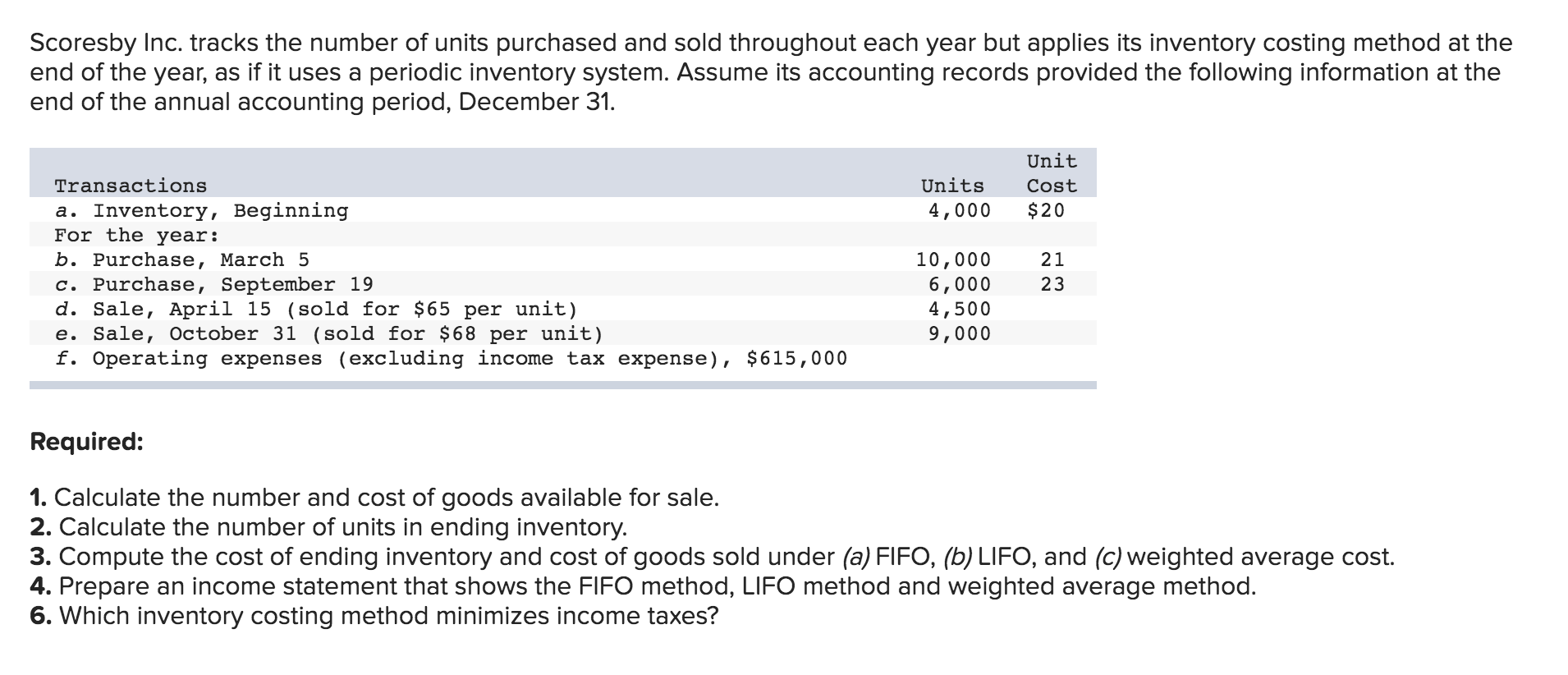

Also, LIFO may allow the company to manipulate net income by changing the timing of additional purchases. The Last-In, First-Out (LIFO) method assumes that the last or moreunit to arrive in inventory is sold first. The older inventory, therefore, is left over at the end of the accounting period. For the 200 loaves sold on Wednesday, the same bakery would assign $1.25 per loaf to COGS, while the remaining $1 loaves would be used to calculate the value of inventory at the end of the period. The First-In, First-Out (FIFO) method assumes that the first unit making its way into inventory–or the oldest inventory–is the sold first.

What are Inventory Costing Methods?

In an inflationary environment, the current COGS would be higher under LIFO because the new inventory would be more expensive. As a result, the company would record lower profits or net income for the period. However, the reduced profit or earnings means the company would benefit from a lower tax liability.

How Inventory Management Tools Affect Costing Methods

Over time, as prices rise, these ending inventory balances become less and less representative of the actual value of that inventory. FIFO is normally considered the costing method crowd favorite because it is considered to create the most accurate picture. Most businesses do want to get rid of their oldest items first and usually consider this approach to be the costing method with the fewest issues to correct for in the long run. Those 75 shirts were taken from the oldest pricing tier (also called a tranche) of shirts. But there are still 125 left at that $12 price point because we bought a total of 200 in that first tranche.

LIFO vs. FIFO: Inventory Valuation

Tax benefit of LIFO The LIFO method results in the lowest taxable income, and thus the lowest income taxes, when prices are rising. The Internal Revenue Service allows companies to use LIFO for tax purposes only if they use LIFO for financial reporting purposes. Companies may also report an alternative inventory amount in the notes to their financial statements for comparison purposes. Because of high inflation during the 1970s, many companies switched from FIFO to LIFO for tax advantages. When a company selects its inventory method, there are downstream repercussions that impact its net income, balance sheet, and ways it needs to track inventory.

In other words, the beginning inventory was 4,000 units for the period. $15, because they were the last items bought, so they are the first items sold. However, it does create the lowest COGS numbers when prices are rising, which can result in the highest taxable income.

The weighted-average method also allows manipulation of income. Only under FIFO is the manipulation of net income not possible. In addition to being allowable by both IFRS and GAAP users, the FIFO inventory method may require greater consideration when selecting an inventory method. Companies the inventory costing method that results in the lowest taxable income in a period of rising costs is: that undergo long periods of inactivity or accumulation of inventory will find themselves needing to pull historical records to determine the cost of goods sold. Since LIFO uses the most recently acquired inventory to value COGS, the leftover inventory might be extremely old or obsolete.

As a result, LIFO doesn’t provide an accurate or up-to-date value of inventory because the valuation is much lower than inventory items at today’s prices. Also, LIFO is not realistic for many companies because they would not leave their older inventory sitting idle in stock while using the most recently acquired inventory. More importantly, we will explain how each inventory costing method can impact your business and why you would choose one over the other. Most companies that use LIFO are those that are forced to maintain a large amount of inventory at all times. By offsetting sales income with their highest purchase prices, they produce less taxable income on paper. Last in, first out (LIFO) is a method used to account for business inventory that records the most recently produced items in a series as the ones that are sold first.

- Under LIFO, these higher costs are charged to cost of goods sold in the current period, resulting in a substantial decline in reported net income.

- The larger the cost of goods sold, the smaller the net income.

- In an inflationary environment, the current COGS would be higher under LIFO because the new inventory would be more expensive.

- Below are some of the differences between LIFO and FIFO when considering the valuation of inventory and its impact on COGS and profits.

- It is up to the company to decide, though there are parameters based on the accounting method the company uses.

Some accountants argue that this method provides the most precise matching of costs and revenues and is, therefore, the most theoretically sound method. This statement is true for some one-of-a-kind items, such as autos or real estate. For these items, use of any other method would seem illogical. Advantages and disadvantages of LIFO The advantages of the LIFO method are based on the fact that prices have risen almost constantly for decades. LIFO supporters claim this upward trend in prices leads to inventory, or paper, profits if the FIFO method is used. During periods of inflation, LIFO shows the largest cost of goods sold of any of the costing methods because the newest costs charged to cost of goods sold are also the highest costs.

Based on the LIFO method, the last inventory in is the first inventory sold. In total, the cost of the widgets under the LIFO method is $1,200, or five at $200 and two at $100. But there are still 25 left at the $15 price point because we bought 100 in that tranche.

So, the cost of the widgets sold will be recorded as $900, or five at $100 and two at $200. How do we know whether this particular shirt was bought at $12 or $15? We place products in pricing tiers when they are bought and then make a general assumption on the order that those pricing tiers will pulled off the shelf and sold.

Generally, companies use the inventory method that best fits their individual circumstances. However, this freedom of choice does not include changing inventory methods every year or so, especially if the goal is to report higher income. Continuous switching of methods violates the accounting principle of consistency, which requires using the same accounting methods from period to period in preparing financial statements. Consistency of methods in preparing financial statements enables financial statement users to compare statements of a company from period to period and determine trends.