Let Me Show You How to Determine Project Budget Reserves

Preferably with multiple team members to get several sets of eyes on it. This should be done during the project’s discovery phase, and you will best be able to define the project scope once you’ve gathered 7 Things You Need To Know About Contingency Budgets all project requirements. Our WBS template incorporates project costs, so feel free to use that as your template. Bottom-up estimating considers the time, cost, and effort for each task within the project.

- Once you or your team accurately tracks time against the project, you can use the Project Dashboard to track your progress against the project budget.

- Once the project is underway, track project expenses against the budget to ensure you stay on track.

- As you create your plan, continuously check in with your sponsors to ensure you’ve addressed key risks and that your action plan is solid.

- By designing plans that take contingencies into account, companies, governments, and individuals are able to limit the damage done by such events.

- While your fixed costs do not offer you much—if any—flexibility with regards to saving, your variable costs do.

So, you’ve worked out why you want to budget, what you want to save for, and what your fixed and variable costs are. While severe earthquakes aren’t particularly common, being unprepared when “the big one” strikes could prove to be catastrophic. This is why governments and businesses in regions prone to earthquakes create preparedness initiatives and contingency plans. For more reading on cost estimation and budgeting in project management, go check out our guide on estimating the cost of a project. Banks are required to have a specific percentage of capital reserves on hand, depending on the total of risk-weighted assets (RWAs).

How to Choose the Right Meeting Cadence for Your Team

A thorough contingency plan minimizes loss and damage caused by an unforeseen negative event. For example, a brokerage company may have a backup power generator to ensure that trades can be executed in the event of a power failure, preventing possible financial loss. A contingency plan can also reduce the risk of a public relations disaster. A company that effectively communicates how negative events are to be navigated and responded to is less likely to suffer reputation damage. These features make it easy to input cost estimates, project plan your resource management, and see where you should be budget-wise at any point in the budget timeline.

- Most assuredly, lenders will require a CR for a construction loan program.

- Head over to the Insights Dashboard—it’s designed to give you more details about the profitability of your projects and team members.

- I created this website to give you practical, actionable project management strategies, helping you reach more of your true potential.

- Your organization might have or require separate documentation for contingency release.

- This article demonstrates why it’s important to take contingency planning seriously.

If you’re the project’s senior manager, you’ve probably estimated or forecasted the cost of the work in terms of both money and time. A strategy known as contingency planning is made specifically for unforeseen future events. In order to make sure that operations run as smoothly as possible, a proactive approach is taken.

What is a contingency plan? 9 steps that could save your business when crisis strikes

Businesses need to identify their critical business functions and perform an analysis of how an event might impact the company’s operations and processes. The contingency plan would include implementing the recovery of critical business functions such as systems, production, and employee access to technology such as computers. Now that you know how complex project budget management is, you might feel a little intimidated.

- 6 – Risk Management, a contingency plan defines alternate paths for the project in case various risks are realized.

- Once you’ve created your contingency plans, share them with the right people.

- Create a contingency plan for each risk you’ve identified as important.

You’ll want to start with a full project plan that’s made in collaboration with your project team and any stakeholders. You won’t even have numbers to work with at this point — and that’s okay! A good project budget requires you to know the entire project scope and every deliverable your team will be accountable for. The value of contingency planning extends beyond averting unforeseen events and minimizing loss.

Clients and results

Having a combination of both short- and long-term saving goals can make the larger goals seem less intimidating. As you gradually achieve your short-term goals, you may realize how possible it is to save money and be in control of your finances. And this can make your long-term goals feel increasingly attainable. Read on to learn about five of our favorite tried-and-true budgeting tips. Understanding the severity and likelihood of each risk will help you determine how exactly you will need to proceed to minimize the impact of the threat to your business. If your business is particularly data-heavy, for example, ensuring the safety and security of your information systems is critical.

You’ll need to break every deliverable down into a step-by-step progression so you can see every resource that will be necessary. We’ll go into more detail on how to build each of these components into your budget shortly. Sign up for the weekly Project Risk Coach blog posts and receive the Project https://accounting-services.net/federal-discount-rate-definition-impact-how-it/ Management Plan Checklist. This will allow you to deliver projects with fewer problems and greater value. Alternatively, you can provide the CR yourself, as is the case for some homebuyers. The lender places the CR in an escrow account or savings account until the construction is complete.

Asset diversification helps to minimize risk if one asset class, such as stocks, declines in value. The money earned from the options strategy completely or partially offsets the losses from the investment. However, these strategies come at a cost, usually in the form of a premium, which is an upfront cash payment. Contingency plans might involve purchasing insurance policies that pay cash or a benefit if a particular contingency occurs. For example, property insurance might be purchased to protect against fire or wind damage.

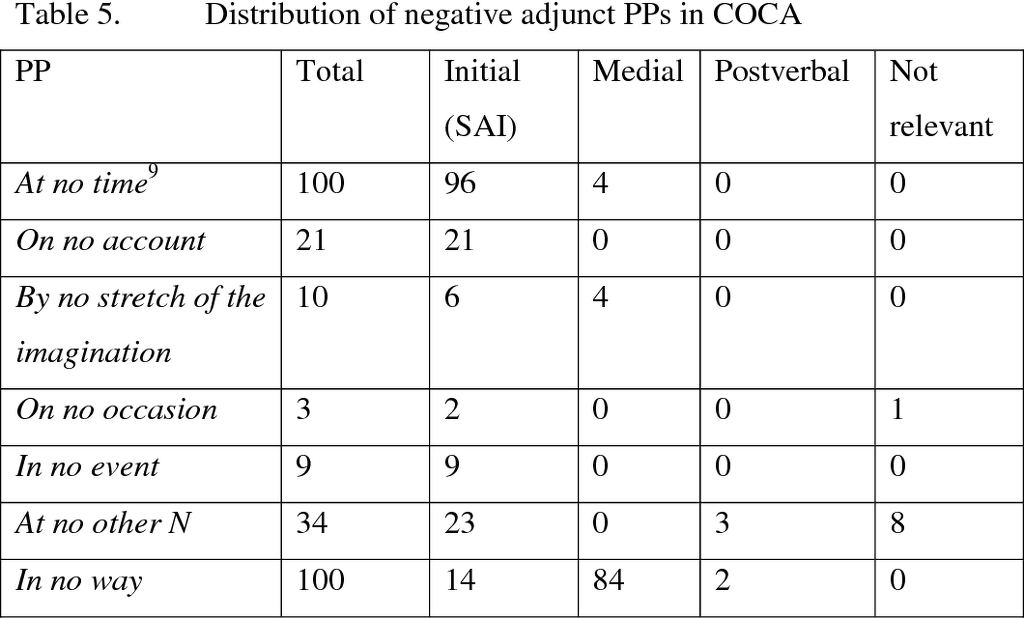

Contingencies are the “oh no” fund in case you really do hit that worst-case scenario budget. For example, a project manager may estimate the project cost to be $100,000. Assuming a 10% contingency reserve, the project manager would estimate the contingency reserve to be $10,000 (i.e., $100,000 x 10%). The project manager would add the contingency reserve to the project estimate resulting in a cost baseline of $110,000.

What if I don’t use all my Contingency Budget?

A contingency plan is a proactive strategy to help you address negative developments and ensure business continuity. In this article, learn how to create a contingency plan for unexpected events and build recovery strategies to ensure your business remains healthy. Assign a dollar amount to each resource you listed in the last step, then sum everything up to get the final project budget. You’ll need to estimate work hours, freelancer rates, and tool costs to get an accurate number. Ask your team (or project managers) for help if you’re not sure what’s reasonable for any given item.

This is typically in the form of additional days incorporated in scheduled activities. Another advanced method for working out your contingency reserve amount is to define the class of estimate for your project budget (the level of certainty). Life always comes with a few surprises, so it’s a good idea to have a budgeting contingency plan for when things get a little complicated. One of the best budgeting tips is to prepare for when you may not be able to stick so closely to your plan. This stops you from becoming demotivated and losing track of your budgeting goals completely. Review your contingency plan frequently to make sure it’s still accurate.

The $6,050 management reserve would be added to the $121,000 resulting in a total project budget of $127,050. Management reserves are for “unknown risks” or risks that were not identified in risk management. A common method for estimating the management reserve is to add 5-10% of the cost baseline for the management reserve.

- One of the most common challenges in project management is fighting off project risks from consuming your budget.

- Your budget can only help you track your progress and control costs and scope if you keep it current.

- Contingency reserves are for “known risks” identified in risk management.

- You’ll want to start with a full project plan that’s made in collaboration with your project team and any stakeholders.

- Apply project risk management at the beginning of the project planning process to prepare for any risks that might come up.

- A company that effectively communicates how negative events are to be navigated and responded to is less likely to suffer reputation damage.