Average Inventory Defined: Formula, Use, & Challenges

Contents:

The average inventory days formula sales of inventory is a financial ratio that indicates the average time in days that a company takes to turn its inventory, including goods that are a work in progress, into sales. Finding the days in inventory for your business will show you the average number of days it takes to sell your inventory. The lower the number you calculate, the better return on your assets you’re getting.

- It isn’t necessarily bad if you are going to have enough sales to keep your revenue up.

- Only compare the average inventory period to companies with like industries.

- Say a company has inventory that’s worth $43,780 and its cost of goods sold is worth $373,400 for the year 2018.

- Retailers who sell perishable items have a smaller number of days in inventory than a company that sells cars or furniture.

Basically, DSI is an inverse of inventory turnover over a given period. For example, a drought situation in a particular soft water region may mean that authorities will be forced to supply water from another area where water quality is hard. It may lead to a surge in demand for water purifiers after a certain period, which may benefit the companies if they hold onto inventories. Here, we will use the simple average to find out the average inventory of the year. Therefore, we will use a simple average to find out the average inventory of the year.

Days Sales in Inventory Template

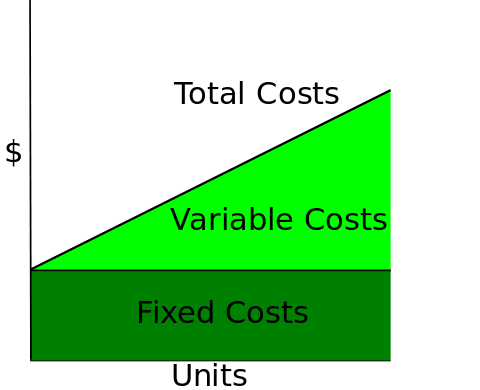

Average inventory is an estimation of the amount or value of inventory a company has over a specific amount of time. Inventory balances at the end of each month can fluctuate widely depending on when large shipments are received and when there’s a buying surge or peak season that may markedly deplete the inventory. An average inventory calculation evens out such sudden spikes in either direction and delivers a more stable indicator of inventory readiness. Inventory management is key to managing costs and maintaining customer satisfaction. Too much inventory on hand means capital is tied up unnecessarily and may even be at risk.

The more liquid the business is, the higher the cash flows and returns will be. Management is also interested in the company’s days sales in inventory to determine how fast inventory moves, which is important when taking storage and maintenance expenses of holding inventory into account. For a company that sells more goods than services, days sales in inventory is an important indicator for creditors and investors, because it shows the liquidity of a business. The interested parties would want to know if a business’s sales performance is outstanding; therefore, through this measurement, they can easily identify such. To calculate the average inventory period, you divide the number of days in the period by the inventory turnover. Average inventory period may not pinpoint exactly the reason why the period the product is staying on the shelves is long.

Since a major part of the “days in inventory formula” includes the inventory turnover ratio, we need to understand the inventory turnover ratio to comprehend the meaning of the inventory days formula. Average inventory by definition must be calculated over at least two periods. That means you can average two or more months, quarters or other time periods. Average inventory will lessen the impact of spikes and dips in inventory to render a more stable measure to base decisions upon or to compare to other metrics.

In addition, goods that are considered a “work in progress” are included in the inventory for calculation purposes. Average inventory period refers to a financial ratio used to compute the average number of days a company takes before they sell all their current stock of inventory. In other words, AIP is the duration goods are sitting on the shelves for before they’re sold.

Average Inventory Period

Retailers who https://1investing.in/ perishable items have a smaller number of days in inventory than a company that sells cars or furniture. Therefore, compare your days in inventory with other businesses in the same industry to determine if you are selling your inventory efficiently. This gets around the problem of blending everything together in averages, discussed above. That kind of data can be valuable to many business leaders, from product managers up to the CEO.

- Of Inventory or a large supply of Inventory, Average takes care of such spikes as it takes the mean value of both the Beginning and Ending Inventory.

- Ending Inventory BalanceThe ending inventory formula computes the total value of finished products remaining in stock at the end of an accounting period for sale.

- The average inventory period is the number of days it takes a company to sell all their current stock.

- They all have their own acronyms, which may make you think they’re different from inventory days in some way.

- However, it excludes all the indirect expenses incurred by the company.

One mistake to avoid, however, is to compare the inventory days of companies in completely different industries, as that would be an unfair comparison where the interpretation is likely to be incorrect (i.e. “apples-to-oranges”). A low DSI suggests that a firm is able to efficiently convert its inventories into sales. This is considered to be beneficial to a company’s margins and bottom line, and so a lower DSI is preferred to a higher one. A very low DSI, however, can indicate that a company does not have enough inventory stock to meet demand, which could be viewed as suboptimal. You can easily find the days in inventory calculation in the template provided. By finding out the inventory days, you would be able to calculate both of the above ratios.

What is inventory days on hand?

Keila Hill-Trawick is a Certified Public Accountant and owner at Little Fish Accounting, a CPA firm for small businesses in Washington, District of Columbia. In the example used above, the average inventory is $6,000, the COGS is $26,000 and the number of days in the period is 365. It is recorded as a deduction of revenue and determines the company’s gross margin. The components of the formula are cost of goods sold and average inventory. INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more.

This is often a better lens to view a company’s inventory standing than a single point in time or accounting period. If it’s not provided directly, you can solve for it by dividing the cost of goods sold by the average inventory. That means lower inventory carrying cost and less cash is tied up in inventory for less time. And there’s less risk that inventory expires or becomes obsolete.

A higher turnover ratio means you’re replacing your inventory and moving product. But it can also be an indicator of lost sales if you’re not holding onto enough inventory to meet demand. Benchmark your business against peer company ratios to see how you’re performing. Inventory management software is all but mandatory when using DII for decision-making purposes. Inventory days on hand measures how quickly a business uses up its inventory levels on average. Calculating accurate inventory days on hand allows businesses to minimizestockouts.

Moving average inventory converts pricing to the current market standard to enable a more accurate comparison of the periods. Average inventory period value shows the efficiency of the company in terms of its operations. For instance, a small average inventory period means that the company is more efficient in its operations because it takes less time to turn its stock into cash hence increasing cash flow. A lower DSI is also preferred because it ensures that the company reduces the storage cost. The raw materials inventory for BlueCart Coffee Company is fresh, unroasted green coffee beans.

That holds true if you only sell one type of product, but if you sell multiple products, DII measures the average turnover of inventory, in dollars. You might have some products that clear inventory multiple times in that 40-day span, and others that take much longer to sell. If the inventory days on hand is low, the inventory turnover will be high .

Average Inventory Examples

To calculate the inventory turnover ratio, you would divide the COGS by the average inventory. Average inventory is a calculation of inventory items averaged over two or more accounting periods. To calculate the average inventory over a year, add the inventory counts at the end of each month and then divide that by the number of months. Remember to also include the base month in fiscal year average inventory calculations which also means you would divide that sum by 13 months rather than 12. Average inventory figures for other stretches of time are similarly calculated. You can use the average inventory period calculator below to quickly calculate the average number of days a company takes before they sell all their current stock of inventory by entering the required numbers.

High Quality Kratom For Sale [FREE Shipping On Powders, Capsules & Extract] – Outlook India

High Quality Kratom For Sale [FREE Shipping On Powders, Capsules & Extract].

Posted: Fri, 24 Mar 2023 05:48:07 GMT [source]

Based on the recent downward trend from 40 days to 35 days, the company seems to be moving in the right direction in terms of becoming more efficient at clearing out its inventory quickly. In the best-case scenario, no further action might be necessary, as the accumulation of inventory could be a byproduct of targeting a niche customer segment and operating in a cyclical market that balances out over the long run. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst. Inventory days formula is equivalent to the average number of days each item or SKU is in the warehouse. A3PLlike ShipBob helpsdirect-to-consumer brandsmanage their inventory and ship orders quickly and affordably. To see if you’re a good fit and to get a pricing quote, click the button below. ShipBob’s technology powers our network of fulfillment centers across the country.

How to Calculate and Interpret Inventory Turnover – Practical Ecommerce

How to Calculate and Interpret Inventory Turnover.

Posted: Wed, 18 Mar 2020 07:00:00 GMT [source]

He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. « This helped me calculate the DSO and DSI and determine the collection days. » It might mean that you don’t have enough stock to satisfy customer needs. You could be losing sales if a customer comes to buy things and they’re out of stock.

In general, the fewer days of inventory on hand, the better — and we’ll explain why in this article. Generally, a small average of days sales, or low days sales in inventory, indicates that a business is efficient, both in terms of sales performance and inventory management. A low DSI reflects fast sales of inventory stocks and thus would minimize handling costs, as well as increase cash flow. The average inventory period, or days inventory outstanding , is a ratio used to measure the duration needed by a company to sell out its entire stock of inventory.

Keila spent over a decade in the government and private sector before founding Little Fish Accounting. Mack Robinson College of Business and an MBA from Mercer University – Stetson School of Business and Economics. Average inventory is the median value of inventory within an accounting period. DII calculations matter more for companies that deal primarily or exclusively in physical goods, and especially so for those that sell perishable inventory. The longer products remain on hand, the more a company’s cash is tied up in inventory. It may also mean production is too high or sales are slowing down.