The Minnesota Board of Accountancy is an affirmative action / equal opportunity employer. The Board does not discriminate in employment on the basis of race, color, creed, religion, national origin, sex, marital status, disability, public assistance, age, sexual orientation, or membership on local human rights commission. If you only just submitted the renewal application, add an appropriate number of delivery days plus 2-3 business days for processing before checking, as the renewal may otherwise still be in progress. All late renewals or status changes now include a $50 delinquency fee, in addition to any license/permit fee. Use Labor’s Central Scheduling System to meet with a representative from one of our boards or commissions. Please select the type of appointment you need from our list of available in-person services using the drop-down menu on the scheduler.

What are the 3 types of accountancy?

To track a business's income, a business can follow three types of accounting that are managerial accounting, financial accounting, and cost accounting.

Job placement is strong among our graduates, who join a large alumni network that reaches to the top ranks of public accounting firms, corporations, non-profits, educational institutions and government agencies. The accountancy program prepares graduates to pursue careers as certified public accountants, private accountants, financial managers, financial analysts, internal auditors, certified management accountants, and government auditors. Graduates are also prepared for advanced study in the fields of law or business. Students who minor in accountancy augment other majors with knowledge and skills that are transferable to a wide variety of careers. John specializes in accounting and auditing for large, multinational commercial and investment banks as well as consumer finance businesses.

Current Licensees

Although accounting and accountancy are often used interchangeably, each term has its own unique definition and practical uses. The Board Report, the official newsletter of the Minnesota Board of Accountancy, contains summaries of enforcement actions and other news of interest to licensees and the public. Note that if you have only just recently renewed or become licensed, the card may not be available for 3-5 business days. These accrue monthly, based on the postmarked date the Board receives your certificates of completion and fee.

In the process, you’ll gain real-world experience—and help local community residents receive much-needed tax refunds. During your time as an accountancy student at Notre Dame, you’ll learn to analyze, evaluate and communicate the results of business activities. In other words, you will develop a highly-sought after critical thinking and decision-making skill set—and use that to advance the greater good.

CPA, MBA

Stacey has served on the Board of the Junior League of South Bend, is an instructor for the Human Resources Certification Institute, and is the Lead University Partner for the firmwide relationship with the University accountancy of Notre Dame. Brad teaches an accounting research class as well as Corporate Financial Reporting, an elective in the MBA program. Badertscher earned his MBA and PhD in Accounting from the University of Iowa.

- While resolving the technical issue requires the assistance and support of the third parties and other external factors, the Board will provide all relevant updates here on the homepage of our website.

- Job placement is strong among our graduates, who join a large alumni network that reaches to the top ranks of public accounting firms, corporations, non-profits, educational institutions and government agencies.

- She assisted with leading internal projects focused on IT risk from both a central and property-level perspective.

- Their responsibilities run the gamut, from auditing financial statements and preparing tax returns to suggesting investment strategies.

- Lastly, John is the Advisory Service Line Risk Management Partner overseeing much of the non-IT attestation work performed by the firm’s advisory practice, principally our securitization agreed upon procedures and Regulation AB work.

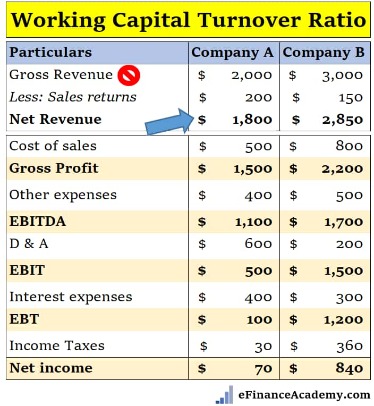

An auditor is also required to identify circumstances in which the generally accepted accounting principles have not been consistently observed. Financial accounting involves the preparation of financial statements — such as balance sheets, income statements and cash flow statements — for internal and external stakeholders. Managerial accounting involves similar functions, but the information is intended primarily to help internal stakeholders make informed business decisions. Cost accounting uses this same data to inform decisions related to the cost of producing specific products or services, right down to how they should be priced at the consumer level. The Panel is a key feature of IFAC’s approach to advancing accountancy education at the global level and instrumental in advising IFAC on how to assist professional accountancy organizations in preparing future-ready accountants. Pete Ugo is an audit partner at Crowe LLP. He has 25 years of audit and consulting experience with Crowe and is the leader of the firm’s national not-for-profit and higher education audit practice.

Examples of accountancy

Stacey Cloutier is the Lead Talent Director serving the Deloitte Advisory business. She is responsible for the strategy and delivery of Talent services for 15,000 professionals. She leads a team of Talent professionals, connects with all facets of the Talent and business organizations, and is a member of Deloitte’s National Talent Leadership team. As organizations expand, complying with all relevant indirect tax rules and regulations becomes… Celebrating excellence in accountancy practice, the Top 50+50 Accountancy Firms 2022 spotlights top accounting firms in the UK Read More… The information in the general ledger is used to derive financial statements, and may also be the source of some information used for internal management reports.